Tangible personal property tax is an ad valorem assessment against the furniture, fixtures, and

equipment located in a business. It may apply to structural additions to mobile homes. The Palm

Beach County Property Appraiser determines the value of tangible personal property.

Assessments less than $25,000

The Palm Beach County Tax Collector is responsible for collecting tangible personal property taxes. If your tangible personal property is assessed at $25,000 or less, you do not need to pay tangible personal property tax. Assessments of $25,000 or less require an initial return filed with the Palm Beach County Property Appraiser’s Office. If the value remains below $25,000, there is no requirement to file subsequent returns. For more information, please contact the Palm Beach County Property Appraiser’s Office.

Tangible Personal Property Tax Liability

Tax liability follows the personal property, not the owner. If you purchase a business or property and

the tangible personal property tax is not paid, a warrant (lien) remains with the tangible personal

property. Although the warrant can be issued in the name of the former owner, the lien attaches to

the tangible personal property and survives all sales or transfers. Learn more.

Payment Options

We offer several convenient ways for you to pay your tangible personal property tax. Click the button below to view your payment options.

Discounts for Early Payment

November

4% Discount

December

3% Discount

January

2% Discount

February

1% Discount

March

No Discount

April

Tangible Taxes Become Delinquent. Subject to Penalties and Interest.

Florida Statute extends discount/payment deadlines falling on a Saturday, Sunday, or holiday to the next business day.

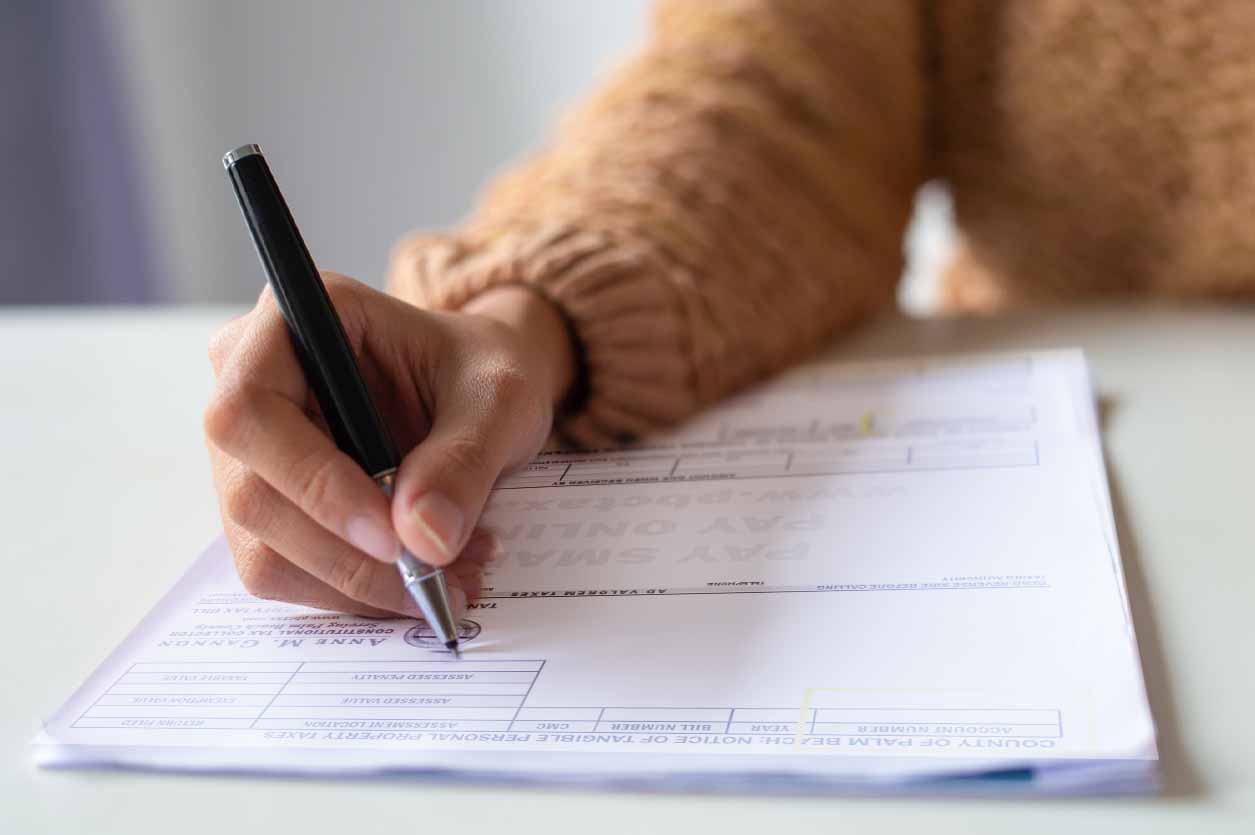

Understanding Your Tangible Personal Property Tax Bill

Below is an interactive breakdown of your tangible property tax bill. Click on the colored icon numbers for an explanation of each item on your tangible property tax bill.

Tangible Personal Property Account Number (TPP)

A unique number is assigned to each property. Refer to this number when making inquiries.

Property Owner(s)

Verify ownership. If the property has been sold, forward the bill to the new owner(s) or notify us by completing our online form Property Sold

Mailing Address

If your mailing address has changed, contact the Property Appraiser at (561) 355-2866.

Assessed, Exemption & Taxable

Some exemptions are only applicable to certain taxing authorities.

QR Code

Scan to be directed to the payment portal.

Assessed, Exemption & Taxable

Some exemptions are only applicable to certain taxing authorities.

Delinquent Tax Message

If this message is displayed on your bill, please contact the Tax Collector's office at (561) 355- 2264 for the delinquent amount due and payment options.

Delinquent Tax Message

If this message is displayed on your bill, please contact the Tax Collector's office at (561) 355- 2264 for the delinquent amount due and payment options.

Amount Due

Pay early and receive one of the following discounts: 4% in Nov., 3% in Dec., 2% in Jan., 1% in Feb. Gross amount due March 31, no discount applies.

Amount Due

Pay early and receive one of the following discounts: 4% in Nov., 3% in Dec., 2% in Jan., 1% in Feb. Gross amount due March 31, no discount applies.

Frequently Asked Questions

Why is there a penalty on my tangible personal property tax bill?

The penalty is determined by the Property Appraiser’s Office and affects any taxpayer who fails to file a return by the March 31 deadline. For more information, contact the Property Appraiser’s Office at (561) 355-2896.

Why did I receive a tangible personal property tax bill if I filed for bankruptcy?

Tangible Personal Property tax bills are sent regardless of bankruptcy status. This bill gives you the opportunity to verify the value of your personal property, which may be assessed during your bankruptcy proceedings.

I went out of business. What should I do?

If you were in business as of January 1, of the assessment year, your tax bill is valid and must be paid. In addition, you must notify the Property Appraiser’s office at (561) 355-2896. Inform their office that you are no longer in business, so they do not assess you for the next year.

Didn't receive your bill?

Tangible personal property tax bills are mailed November 1. You can view, print or pay your tangible personal property tax bill online.

1. Search your property

2. Locate the year of the bill you would like to print

3. Click the “View Info” link located under “Roll:Annual”

4. Scroll to the bottom and click the “Original” button under Download Your Tax Bill

Closing a Business?

If you were in business as of January 1 of the assessment year, your tax bill is valid and must be paid. You must notify the Property Appraiser’s office at (561) 355-2896 to advise that you are no longer in business and the status of the assets to avoid an assessment for the following year.